Real estate has long been regarded as the ultimate store of value, and for good reason. From its historical significance to its ability to generate wealth and withstand economic fluctuations, real estate remains a cornerstone of financial stability and growth. In Nairobi, Kenya’s bustling metropolis, the property market has become a hotspot for investors, both local and international.

This article explores why real estate is a reliable store of value, with a focus on Nairobi’s property market, supported by data from the Kenya National Bureau of Statistics (KNBS) and insights into land prices in key areas like Syokimau, Katani, Kitengela, Kamakis, and Kamulu.

1. Historical Significance of Real Estate

Real estate has been a symbol of wealth and power for centuries. In Kenya, land ownership has always been a critical factor in economic and social status. During the colonial era, land was a primary resource controlled by the colonial government, and post-independence, it became a key driver of economic empowerment. Today, Nairobi’s real estate market reflects this legacy, with land and property being among the most sought-after assets.

According to the KNBS, the real estate sector contributed approximately 7.2% to Kenya’s GDP in 2022. This growth is fueled by rapid urbanization, a growing middle class, and increased demand for housing and commercial spaces. Nairobi, as the economic hub of East Africa, has seen its property market thrive, with satellite towns like Syokimau, Kitengela, and Kamulu emerging as prime investment destinations.

2. Tangibility and Scarcity: The Pillars of Real Estate Value

One of the most compelling reasons real estate is a reliable store of value is its tangibility. Unlike stocks, bonds, or cryptocurrencies, real estate is a physical asset that you can see, touch, and use. This tangibility provides a sense of security and permanence that other investments cannot match.

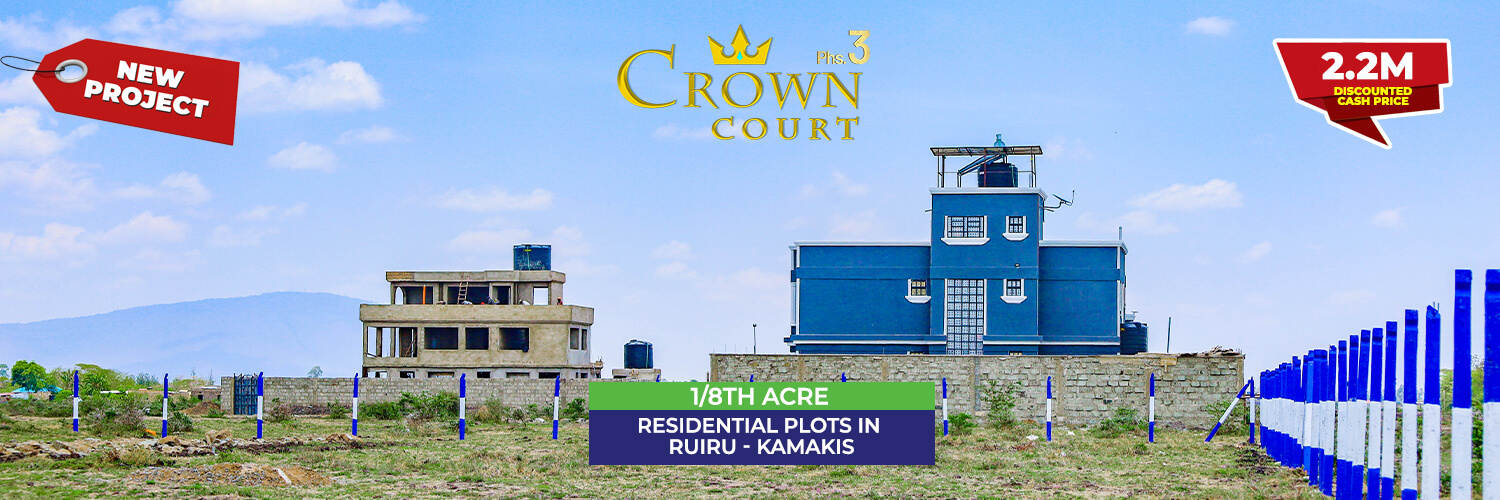

Another critical factor is scarcity. Land, especially in prime locations, is finite. As Nairobi’s population grows—currently estimated at over 4.7 million—the demand for land in the city and its outskirts has surged. Satellite towns like Syokimau, Katani, Kitengela, Kamakis, and Kamulu have become hotspots for investors seeking affordable land with high potential for appreciation.

Here’s a breakdown of current land prices in these areas:

- Syokimau: An acre of land now costs between Ksh 15 million and Ksh 25 million, up from Ksh 8 million in 2018.

- Kitengela: Prices have risen to Ksh 10 million per acre, compared to Ksh 5 million five years ago.

- Kamakis Land prices have doubled, now ranging between Ksh 7 million and Ksh 14 million per acre.

- Katani: An acre of land costs between Ksh 8 million and Ksh 15 million, depending on proximity to infrastructure.

These price increases reflect the growing demand for land in Nairobi’s satellite towns, driven by improved infrastructure, such as the Nairobi Expressway, the Eastern Bypass and the Standard Gauge Railway (SGR), which have enhanced connectivity to the city center.

3. Real Estate as an Inflation Hedge

Real estate is a proven hedge against inflation. When the cost of living rises, property values and rental incomes tend to increase as well. This means that real estate investments grow in tandem with inflation, preserving your purchasing power over time.

In Kenya, inflation has averaged around 6% over the past decade. However, real estate has consistently outperformed this rate. According to the Hass Property Index, residential property prices in Nairobi have grown by an average of 8% annually. Rental yields in the city are equally impressive, averaging 7-10% annually, with high-demand areas like Syokimau and Kitengela offering yields of up to 10%.

For example, a residential property in Syokimau purchased for Ksh 10 million in 2018 could now be worth Ksh 18 million or more, while generating monthly rental income of Ksh 80,000 to Ksh 120,000. This dual benefit of capital appreciation and rental income makes real estate a powerful wealth-building tool.

4. Diversification and Legacy Building

Real estate offers diversification, making it a low-risk asset class that balances out volatile investments like stocks or forex. It’s also a legacy asset that can be passed down through generations, creating long-term wealth for families.

In Nairobi, many families have seen their wealth multiply as satellite towns develop. For instance, a plot bought in Kamulu for Ksh 1 million in 2010 is now worth over Ksh 5 million. Similarly, land in Kitengela that cost Ksh 2 million per acre a decade ago now sells for Ksh 10 million or more.

The development of infrastructure, such as roads, schools, and shopping centers, has further boosted the value of land in these areas. For example, the ongoing expansion of the Eastern Bypass has significantly increased land prices in Kamakis and Kamulu, making them attractive to both residential and commercial investors.

5. The Role of Infrastructure in Driving Land Value

Infrastructure development is a key driver of real estate value in Nairobi and its environs. Projects like the Nairobi Expressway, the SGR, and the expansion of major highways have improved accessibility to satellite towns, making them more attractive to investors.

For instance, Syokimau’s proximity to the SGR terminus and Jomo Kenyatta International Airport has made it a prime location for residential and commercial developments. Similarly, the Eastern Bypass has opened up areas like Kamakis and Kamulu, leading to a surge in land prices and development activity.

According to the KNBS, the construction sector grew by 6.7% in 2022, creating jobs and boosting infrastructure. This growth has had a ripple effect on the real estate market, enhancing the value of land and property in Nairobi and its outskirts.

6. Challenges and Opportunities in Nairobi’s Real Estate Market

While Nairobi’s real estate market offers immense opportunities, it also comes with challenges. High land prices in prime areas, bureaucratic hurdles in land acquisition, and the risk of fraudulent transactions are some of the issues investors must navigate.

However, with proper due diligence and the help of reputable real estate agents and lawyers, these challenges can be mitigated. Additionally, the government’s efforts to streamline land registration and digitize land records through the Ardhi Sasa platform are steps in the right direction.

Conclusion: Real Estate as a Timeless Investment

Real estate remains the ultimate store of value due to its historical significance, tangibility, scarcity, ability to hedge against inflation, and role in diversification and legacy building. In Nairobi, the property market continues to thrive, with satellite towns like Syokimau, Katani, Kitengela, Kamakis, and Kamulu offering lucrative opportunities for investors.

As the city expands and infrastructure improves, the value of land and property in these areas is expected to rise even further. Whether you’re a first-time buyer or a seasoned investor, real estate in Nairobi offers a reliable path to financial security and long-term wealth.

As the old adage goes, “They’re not making more land.” So, invest wisely, and let your property work for you.